By John Moore, Founder & Managing Partner

Chilmark Research

@john_chilmark

Now that NwHIN has been spun-out into the public-private entity Healtheway one has to wonder exactly what value they can deliver to market that will sustain them as they attempt to ween themselves from the federal spigot. Healtheway has no lack of challenges ahead but they intend to target one area that presents an interesting opportunity. Question is: Are they too early to market?

During a recent webinar, Healtheway’s interim executive director, Mariann Yeager, outlined the origin of Healtheway, the apparent traction Healtheway is gaining in the market and what their plan is going forward.

Healtheway got its start via funding from a variety of federal sources, all of whom who were looking for a solution to address their unique problems. For the Social Security Administration it was the need for a nationwide network to facilitate processing of disability claims. For the VA and lesser extent DoD it was the need to enable military personnel to receive care in the public sector and insure that their records were complete. Health & Human Services led most of the development effort leading to NHIN CONNECT, a less than stellar technology platform built by beltway bandits (who else), that hit the market with a thud.

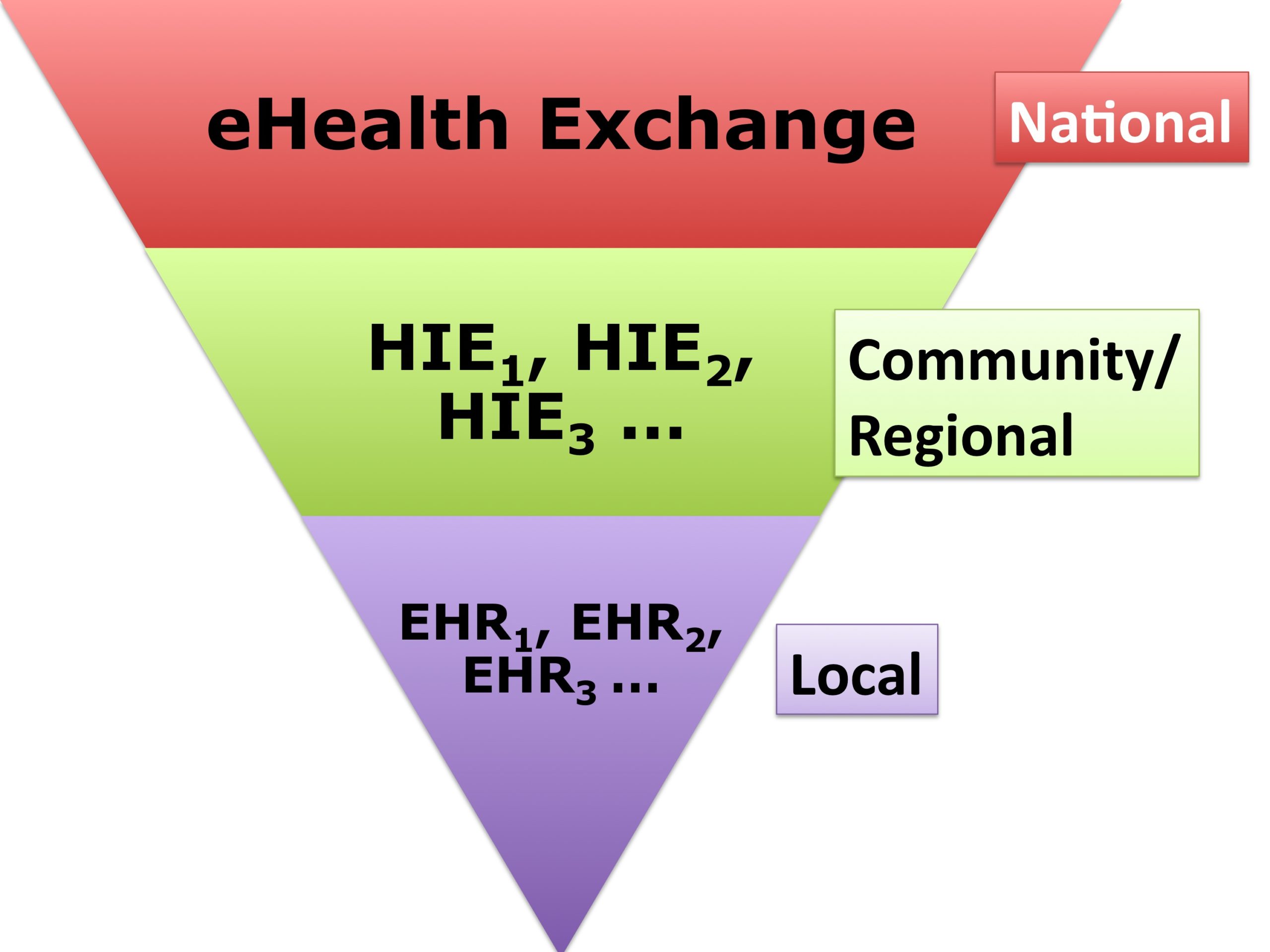

One of the things the feds did get right though is a clear and comprehensive policy for data use sharing across disparate entities. The DURSA (data use and reciprocal support agreement) remains one of the key differentiators in Healtheway’s portfolio. Healtheway’s intent is to leverage the DURSA as the “unifying trust framework” and build upon that with a common set of technical exchange requirements (standards) to facilitate exchange with eHealth Exchange (this replaces the former NwHIN Exchange). Healtheway has also enlisted CCHIT to perform testing of technology vendors solutions to insure they comply with the technical exchange requirements that will allow for HIE-to-HIE connectivity.

That last sentence is the kicker. Healtheway and its eHealth Exchange is not intended to be an uber-national HIE but a set of policies and technical specs that will allow HIEs, be they public or private, to share information across institutional boundaries. Therefore, Healtheway will not get into the current rat’s nest of looking to on-board the multitude of ambulatory EHRs into an HIE but sit one level above that facilitating exchange across HIEs. This is something that many regional and state HIE programs are looking to facilitate, thus it is not surprising to see that a significant proportion of Healtheway members come from such organizations.

There will be a need for this functionality at some future point in time, but not today and likely not tomorrow either. Three key challenges stand in their way:

1) Getting buy-in from healthcare organizations and technology vendors. While membership has indeed grown, Healtheway is offering membership at a discount (likely a loss) to gain traction and unfortunately they still do not have significant traction as many brand names in healthcare are missing.

2) A tainted history with more than its share of missteps. Slowly coming out from under the wing of federal politics as a pseudo independent organization (Board still has plenty of government influence), Healtheway may begin to act more as an independent organization, more like a business. Unfortunately, due to a likely continual need for government funding that independence will likely be limited.

3) The HIE market, both from a technology, policy and implementation/deployment perspective is still primitive. The broad market is simply nowhere near the point of needing what Healtheway intends to offer for a few years to come, at least as it pertains to the exchange of clinical data. Good idea, too early to market. That being said, tehre will be value on the transaction side, e.g., SSA and disability claims processing.

Hopefully the future will prove us wrong on this one and Healtheway will indeed prosper and contribute to the maturity of the HIE market. But our advice, don’t bet on this horse just yet, give them six months than take a second look.

John Moore is the Founder and Managing Partner of Chilmark Research, a well-respected analyst firm providing market leading coverage in a number of critical sub-sectors of the healthcare IT market including: Health Information Exchanges, mHealth and provider-patient engagement strategies. This article was first published on the Chilmark Research website and is used here with permission.