By Kermit S. Randa, CEO, Syntellis Performance Solutions

By Kermit S. Randa, CEO, Syntellis Performance Solutions

Twitter: @Syntellis

Fewer than half of healthcare organizations rely on rolling forecasts, with most favoring annual budgets instead — but COVID-19 is changing that. Drastic reductions to hospital revenue and increased costs from the pandemic have highlighted the value of rolling forecasting, which reexamines financial information on a regular cadence to provide timely visibility into changing financials.

With 2020 budgets blown, healthcare finance leaders are scrambling to adapt planned budgets and wondering how to incorporate rolling forecasting into existing budgeting and financial planning processes. Should they discontinue annual budgeting until after COVID-19? What rolling forecasting techniques work best for healthcare? What length of time should they forecast ahead? Should rolling forecasting replace annual budgets?

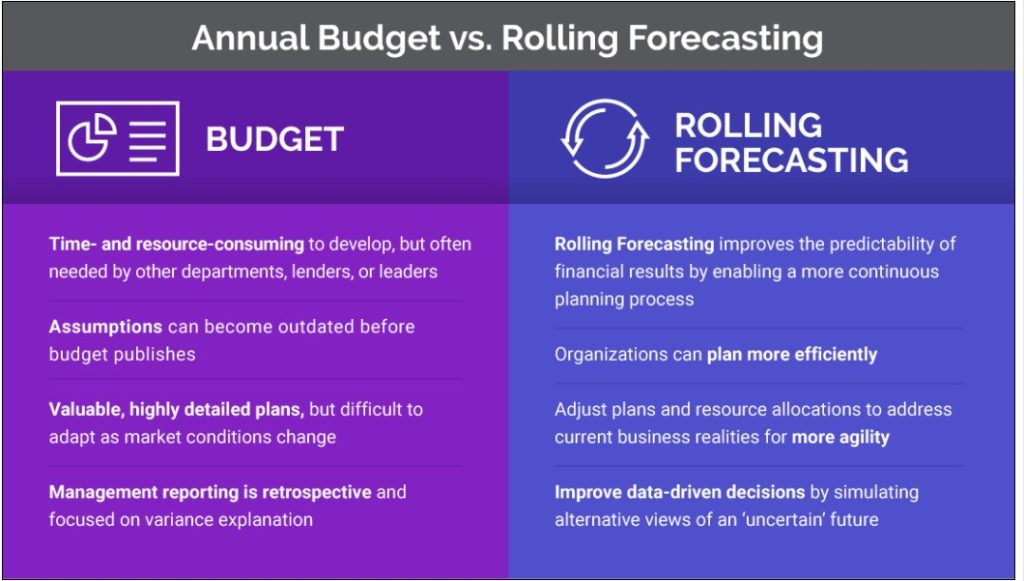

Both annual budgets and rolling forecasts play important roles in today’s healthcare organization and can be incorporated into existing processes without overburdening finance teams.

Annual Budgets Versus Rolling Forecasting

Annual budgets determine the plan for the upcoming year and are generally time-consuming to produce, with nearly 50% of healthcare organizations spending at least six months preparing them. Developing budgets for 2021 and 2022 will still likely be necessary in most organizations because these documents guide development of departmental financial plans and are often required by lenders or leadership. Finance and departmental leaders must recognize, though, that budgeting for 2021 will be unlike any other year — process efficiency and agility will be more important than ever.

Rolling forecasting enables healthcare leaders to update their financial projections on a monthly or quarterly basis to determine, “How has the previous month or quarter changed our view of the present and future?” It provides the intelligence to make course corrections in response to current data around performance and updated projections around near- and long-term conditions. Rolling forecasting not only influences current expenditures and initiatives — such as the ramp-up of traditional services at a time when consumers may be hesitant to return to a hospital setting — but also strategic decisions and future endeavors.

The agility and visibility that rolling forecasting provides helps healthcare leaders adjust strategy quickly as financial conditions change — not just during the pandemic, but over the next year or two, as the aftershocks of COVID-19 are felt.

Rolling Forecasting at Work in Healthcare

Here’s how rolling forecasting works:

- Budget process participants come together for short blocks of time each month or quarter to assess and update the organization’s financial performance

- Participants select the appropriate forecast horizon (e.g., monthly or quarterly periodic forecasts for the current year and up to two years forward)

- Using the most recent data available, comparative and trend analyses are performed, often taking multiple scenarios into account. For example, to analyze the forecast for sensitivity and risk, organizations typically test against at least three sets of conditions, with favorable, unfavorable, and very unfavorable outlooks

- Based on these analyses, leaders evaluate key actions their organization should take now and in the short- and long-term to strengthen and protect the organization’s performance

When using rolling forecasting, most healthcare organizations create forecasts for six to eight quarters — a longer time horizon than either current-year forecasting or traditional budgeting processes provide.

Scripps Health, a nonprofit health system based in San Diego, recently completed its ninth quarterly rolling forecast. Since the beginning of the pandemic, John F. Wong, director of corporate financial planning and reporting at Scripps Health, has shared details about how rolling forecasting has informed Scripps Health’s response to shifts in patient volumes during the COVID-19 pandemic.

For example, the system runs daily reports that monitor charges and productive hours to track the impact of reduced elective procedures and the corresponding flexed labor. Because these decisions are made differently at each of five hospitals, rolling forecasting helps leadership understand the impact by location and by department — showing which departments are flexing properly and where volumes are dropping. This has helped guide decisions such as when to close certain clinic sites and departments temporarily, and which resources to repurpose in the event of a surge.

When Scripps’ daily charges report showed a 35%-37% drop in volume, finance leaders began analyzing the revenue impact over a two-week period and projecting volumes quarterly. As volumes picked up, daily analyses helped make staffing and supply adjustments, with an eye toward patient acuity levels.

As Scripps Health began its return to elective procedures, rolling forecasting also informed which departments to open for service and how to adjust staffing for anticipated versus actual volumes. Ultimately, the cost data captured also will support Scripps Health’s efforts to receive federal dollars for COVID-19 response, such as funds available through the CARES Act.

Each quarter, Scripps Health’s finance team makes process improvements to expedite decision-making, even during this period of volatility. They strive to improve every quarter — prioritizing the time to think strategically and critically about issues, not allowing themselves to be solely driven by a specific deadline. Wong said that rolling forecasting empowers his health system to make the right decisions in a changing environment.

5 Steps to Seamlessly Integrate Rolling Forecasting Best Practices During COVID-19

Adding rolling forecasting processes might sound impossible as finance teams are already working hard to help guide their hospitals and health systems through unprecedented change and volatility. But this is the perfect opportunity to leverage financial and operational data to inform strategic decisions — which 96% of healthcare CFOs think their organizations should be doing better — while actually reducing workloads using the right software tools.

Here’s how:

- Look for opportunities to improve existing budgeting processes. You can significantly reduce staff effort and process time without compromising essential budget information by consolidating relevant data into one system, automating budgeting processes with modern technology, and getting the right people involved at the right time.

- Look for a rolling forecasting solution designed for healthcare. Rolling forecasting is manually intensive when you don’t have the right tools for the job, so this is critical. Rolling forecasting solutions should provide a higher level of detail than traditional budgeting. This makes it possible to focus on rate-per-unit variances, for example, as opposed to traditional budgeting, which focuses on dollar amount variance. The level of detail is equivalent to a director-level view rather than a general ledger view.

- Determine your forward-looking timeframe. Advanced rolling forecasting capabilities should include the ability to create 24- and 36-month forecasts, which will provide valuable insights to guide budgets and financial plans during and after the pandemic.

- Connect key financial systems. In addition to providing short-term managerial guidance, rolling forecasting should integrate seamlessly into the larger financial decision-making process, which includes strategic planning, financial planning, budgeting/forecasting, capital allocation, capital budgeting, and outcomes measurement.

- Consider reporting needs. Biweekly or more frequent productivity reporting should roll up into monthly performance reports, which inform rolling forecast updates on that monthly and/or quarterly basis. In turn, these rolling forecasts can be used to update strategic planning and associated initiatives, financial plans, and capital allocation and management.

With rolling forecasting, actual performance and a better understanding of future conditions can influence strategic decisions, organizational initiatives, plans, and expenditures — driving financial performance improvement across the healthcare organization.