By Marty Callahan, President, Healthcare Markets, RevSpring

By Marty Callahan, President, Healthcare Markets, RevSpring

Twitter: @RevSpringInc

Is your organization scrambling to solve escalating revenue loss created by high-deductible health plans? You’re not alone. The rising volume of patient out-of-pocket payments reported as uncollected correlates directly to the increasing portion of insured patients covered by HDHPs.

What Is an HDHP?

HDHPs are plans with a minimum deductible and maximum out-of-pocket limits as defined by the Internal Revenue Service. Other than certain preventive services, all medical care must be paid for out of pocket until the deductible is met.

The IRS defines a high-deductible health plan as any plan with a deductible of at least $1,350 for an individual or $2,700 for a family. Total yearly out-of-pocket expenses cannot exceed $6,650 for an individual or $13,300 for a family.

The Elephant in the Care Delivery Room — HDHPs

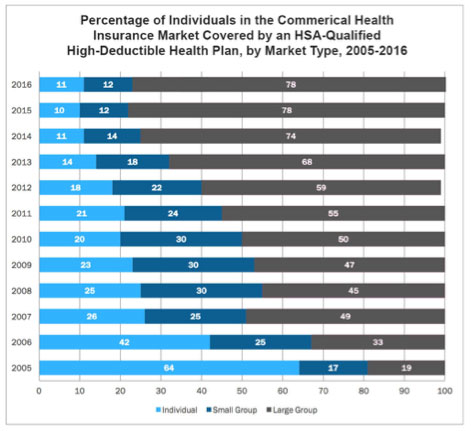

The number of insured consumers choosing HDHPs rose sharply from 1 million in 2005 to 20.2 million in 2016. This 10-year jump demonstrates an increase in overall population coverage — more Americans have coverage under the ACA — but also signals a fundamental shift in the type of coverage insured Americans have.

Once covering a minority of insured Americans (just 19 percent in 2005), HDHPs are now the elephant in the care delivery room, accounting for nearly 80 percent of the commercial insurance market. Both group and individual markets are shifting to HDHPs as their primary plan offering.

Employers Struggle to Balance Cost-Management and Affordability

Many group markets offer only HDHPs to their members. PwC’s Health Research Institute found that 44 percent of employers expected to offer HDHPs as the only benefit option for employees, suggesting that the balancing act of meeting cost-management objectives and employee affordability is getting harder.

HDHPs and the ACA

In the individual market, almost 90 percent of enrollees in ACA marketplaces are in a plan with a deductible above the amount that qualifies as an HDHP. These consumers are also struggling to find a path to affordability by balancing lower upfront out-of-pocket premiums with ever-climbing deductibles.

According to research from the University of Michigan, out-of-pocket hospital care costs rose nearly 40 percent from 2009 to 2013, driven by an 86 percent rise in deductibles and a 33 percent increase in coinsurance. By 2016, out-of-pocket spending increases reached a fever pitch, marking the fastest growth in a decade — a shift led by HDHPs.

The rise of HDHPs in individual and group insurance channels necessitates a deeper analysis and understanding of how care affordability is shifting for all Americans — where payment risk lies and who is really paying for care delivery.

Care Affordability vs. Care Avoidance

Patient payment is not a question of convenience but a problem of affordability. The out-of-pocket deductibles associated with HDHPs are simply not affordable for millions of covered Americans. Patients who can no longer afford care begin to avoid care. Care bills mount, leading to nonpayment.

This domino effect has rocked healthcare finance organizations that see a looming crisis both in hospital finances and in public health. This confluence of forces is accelerating a shift in the way provider organizations respond to patient nonpayment.

Closing the Revenue Gap

Shifting insurance coverage models and shifting financial responsibility forces provider organizations to rethink engagement workflows with their patients. These care delivery teams may feel there is little they can do to stem the tide of HDHP-related nonpayment, but tailored patient engagement is moving the payment collection needle.

Patients engaged throughout the service delivery cycle are more likely to participate fully in billing and payment processes. Patient segmentation and consistent, tailored patient communication — at every engagement touch point — bring alignment between patient financial obligations and what the patient finds financially realistic to pay.

Make Patients With an HDHP a Revenue Cycle Priority

Our next post, “HDHPs — Three Ways to Improve Payment Collection,” will explore ways provider organizations can respond to a changing insurance landscape. Proactive and tailored financial communication helps HDHP policyowners understand their payment obligations and take action.

This article was originally published on RevSpring and is republished here with permission.