By April Wilson, VP, Marketing & Analytics for Healthcare, RevSpring

By April Wilson, VP, Marketing & Analytics for Healthcare, RevSpring

Twitter: @RevSpringInc

With the rising increase in healthcare costs and patient responsibility, it is important for healthcare organizations to understand today’s consumers and the latest trends in patient payments. According to a 2018 TransUnion Healthcare analysis, in 2017, patients experienced an average 11% increase in out-of-pocket costs for their healthcare services. With more patients struggling to reconcile these costs, creating a patient financial engagement system that is in line with today’s patient is not only a benefit to the patient but also to the revenue cycle provider.

Quick Pay is Critical

Healthcare consumers want their experiences with providers to mirror those in the retail/consumer space, especially as patients take on more financial responsibility under high-deductible health plans. In the retail/consumer space, the primary choice for paying a bill has shifted to an online, self-service transaction—the same trend is apparent in the healthcare space. On average, providers are receiving 60 percent of patient payments from online payment portals. Additionally, payment amounts tend to be higher among enrolled patient portal users who have the ability to consolidate accounts, such as their spouse or children accounts, or to have multiple visits and encounters listed on one bill.

Timeliness Matters

On average, 37 percent of consumers pay at statement one, 25.3% at statement two, and 15.3% following a final notice. Statistically, it is essential to understand the components of creating the impression you want within the patient’s first statement. To drive this outcome, the first statement must have a design that is patient-centered allowing for multiple channels of bill pay.

Other Impacts of Time

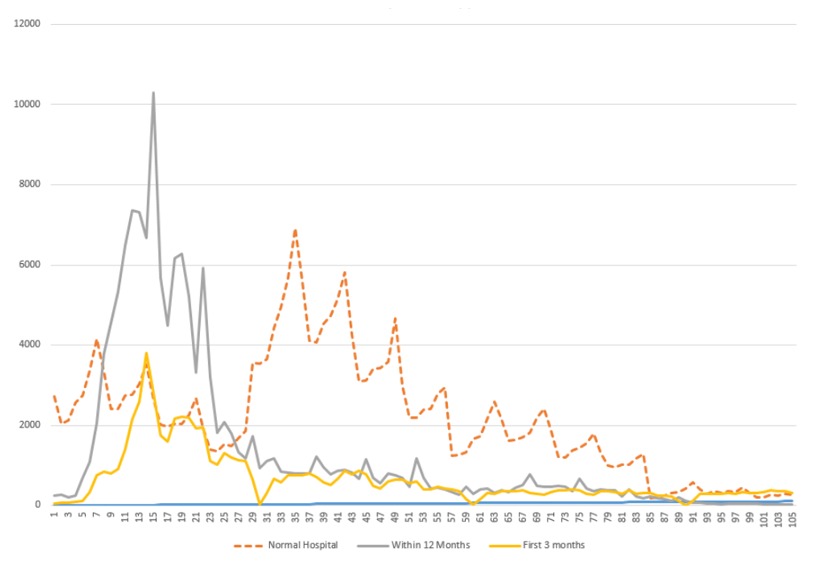

Healthcare providers can expect an average 21 days to collect payment following the first statement. From this average, 36 percent of payees choose a self-service payment channel averaging about 15 days to collect. If a patient pays by check, the odds are really good that the second statement will go in the mail before the payment by check in the mail arrives.

With these rates, the type of the payment channels that you promote influence not only the time-to-collect but also the cash-to-collect.

Balance Matters

Balance Matters

According to a 2018 survey from Bankrate, “Fifty-seven percent of Americans don’t have enough cash to cover a $500 unexpected expense.” Unfortunately, unexpected medical bills are a common reality for most Americans. Bankrate found that one in five Americans in 2017 faced unexpected medical expenses with an average of $2,782. With the average household income of $65,751, about 4.2 percent of their annual income is going to medical bills.

For many, receiving a bill of this extent results in sticker shock. How providers approach bill pay should vary depending on the balance. For those with a higher balance, the optimal approach would be to promote payment plans or financial assistance.

Patient Engagement Matters

Research has also shown that Americans are receiving more healthcare than ever before. In fact, the average number of visits in 2015 was 1.53 compared to 3.16 in 2017. While the reason for this is unclear, we assume it is the positive strides toward patient engagement from healthcare organizations that is encouraging patients to return to their providers.

Patient engagement matters; and when it comes to your organization’s revenue cycle, ensuring great communication at every touchpoint is critical in developing an intelligent patient payment strategy that provides an excellent patient experience.

This article was originally published on RevSpring and is republished here with permission.