New Report Looks At 2013 EHR Buying Trends

By David Fried, Software Advice

In a press release last Wednesday, the Department of Health and Human Services announced that more than half of eligible providers have now received incentive payments for adoption or meaningful use of electronic health records (EHRs).

Earlier that week, Software Advice, a trusted resource for buyers of medical software such as EHRs, published findings from of a long-term study following demand drivers among prospective buyers of EHR software. That report adds additional context to the impact of the HITECH Act on EHR implementations.

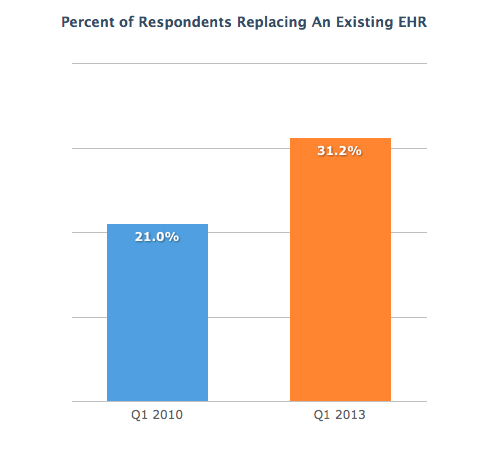

Shortly after the HITECH Act was signed into law, Software Advice analysts speculated that physicians rushing to qualify for stimulus dollars might rush into purchase decisions, leading to unsuccessful EHR implementations and a need for replacements down the road. Since then, the company has gathered data on tens of thousands of practices considering medical software purchases. They analyzed those data to determine demand drivers for EHR software purchases in Q1 2013 vs. Q1

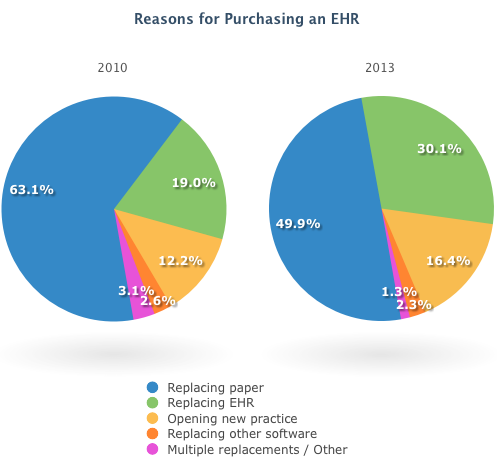

In both sample periods, the self-reported reasons that medical practices adopt EHR software broadly fall into the following categories:

- Replacing paper records

- Opening a new practice

- Replacing other software that wasn’t specifically designed for medical records

- Some combination of the above.

Click on image to enlarge and view in a new window.

Contrast that with the proportion of providers who are replacing existing EHR software, a proportion which increased by nearly half, from 21.0 percent in 2010 to 31.2 percent in 2013. These findings demonstrate that the need to replace existing EHR software is becoming an increasingly bigger driver of EHR purchases.

Replacing EHRs

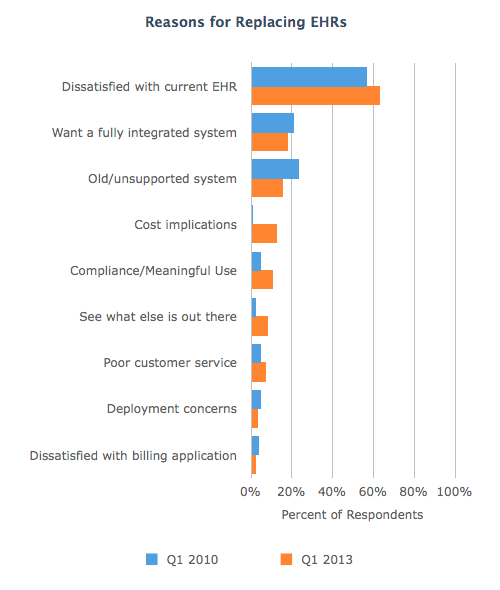

So why are practices replacing their EHRs? Further analysis surfaced the following key reasons. Click on image to enlarge and view in a new window.

Growing Vendor Dissatisfaction

Practices who mention being “unhappy with current EHR” grew by 11 percent, and customer service concerns grew by 50 percent. We also observed a significant rise in cost as a primary concern, with practices indicating in many cases that they were not made fully aware of what the total costs would be.

And this doesn’t even include buyers “looking to see what else is out there,” a category which grew by a whopping 232 percent from 2010 to 2013. Though perhaps not explicitly dissatisfied with their current EHR, these providers don’t seem 100 percent committed to their current solution, either.

Replacing Paper Charts

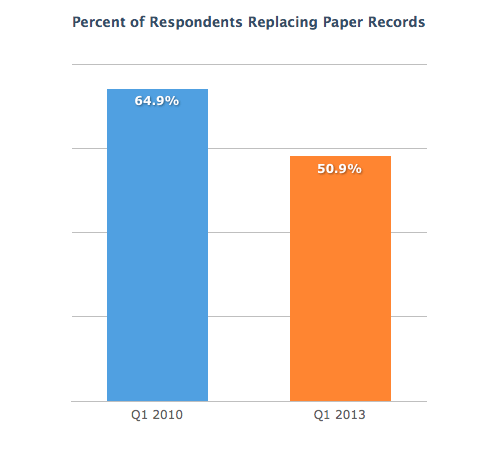

The percentage of buyers replacing paper charts decreased from 64.9 percent in 2010 to 50.9 percent in 2013. So why do buyers want to transition from paper to electronic records?

Due to the method of data collection in 2010, more than half of the respondents replacing paper records during that sample period did not provide a reason why. We are therefore limited in terms of the claims we can make about the reasons for purchase in 2010. That said, among the reasons that were collected for switching from paper, qualifying for incentives ranked a surprising sixth. More predominant reasons were reflective of a general desire to see the benefits of a paperless practice.

However, included separately were several mentions of CCHIT certification and a few mentions of EHR being “required” (which we might assume is a reference to HITECH). If we bundle those reasons in with the “incentives” category, that category rises to first place for 2010.

In Q1 2013, the primary reasons for switching from paper included desire to reduce paperwork and improve efficiency/organization. Qualifying for incentives showed a drop in 2013, falling from 8.2 percent of reasons given in 2010 to 5.4 percent in 2013, perhaps unsurprising given that we’re already well into the reimbursement period.

Running through the results is an undercurrent of inevitability, with 15.8 percent of respondents citing such as “time to make the move.” This sentiment is again indicating of the overall market shifting toward electronic records.

Conclusions

While our findings highlight changing demand drivers for EHR purchasers, what they don’t demonstrate are the countless cases of successful EHR implementations. Because our sample only included potential buyers, the data do not speak to the many practices who are satisfied with their EHR software and have realized benefits in both patient care and the financial health of their practice as a result.

Our report highlights the importance of a rigorous process for software selection and implementation, pointing to the necessity for software buyers of having a reliable product assessment plan. We conclude by encouraging prospective buyers to approach purchases carefully and with a methodical evaluation plan in order to reap the benefits of an electronic practice.

David Fried originally contributed this report to Software Advice, where he currently covers medical practice management, the EMR industry, and political and regulatory issues affecting doctors. Learn more by visiting www.SoftwareAdvice.com.