By Kathy Sucich, Director of Healthcare Marketing, Dimensional Insight

By Kathy Sucich, Director of Healthcare Marketing, Dimensional Insight

Twitter: @DI_tweet

Twitter: @ksucich

The price of healthcare. It’s a hot-button issue for many Americans, and a costly one too. Statistics from the Commonwealth Fund show Americans pay a median of $3,700 each year in premium contributions and out-of-pocket healthcare expenses combined.

With the cost of healthcare so high, consumers should be able to make meaningful decisions about their care and the prices they are willing to pay. But the current system doesn’t allow for much price transparency. There are now many efforts to change that. Let’s examine in this week’s “Hot Topic” blog post.

The $1,500 blood test

Let me start with a personal anecdote about healthcare price transparency (or lack of it). Several months ago, my daughter had some on and off stomach pains. Her doctor was fairly confident that she knew the source of it, but wanted to order some blood tests to rule out celiac disease. So we had the blood draw and waited for the results.

What was not surprising to me was that my daughter didn’t have celiac disease. What was surprising was the cost of the test. The hospital charged my insurance provider $1,500. Insurance negotiated it down to $300, which I was responsible for paying.

I paid that $300, but it didn’t sit right with me. I couldn’t believe the hospital initially charged $1,500 for that test. Yes, hospitals do this all the time – they charge exorbitant prices, which are then negotiated down. That’s par for the course. And a whole other topic to debate.

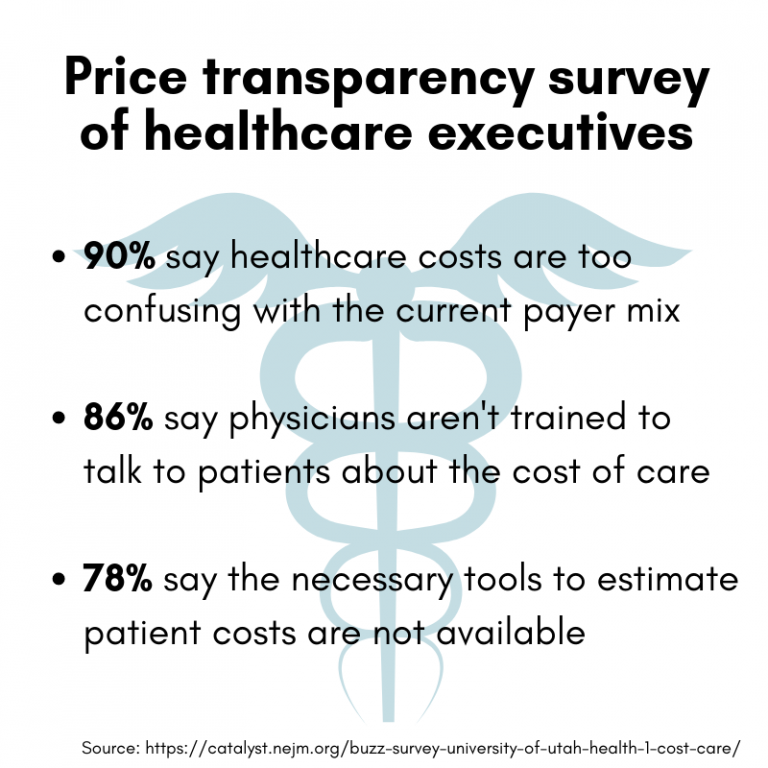

More troubling to me, though, was the lack of transparency in the process. My daughter was being recommended a very expensive blood test. But nowhere in this exchange was cost mentioned. In all truth, my daughter’s pediatrician probably didn’t know the cost of the test either. It’s not that I wouldn’t have gotten the test had I known how expensive it was. If the doctor recommended it, we would have gotten it. But I wished that we had both been more informed in that decision-making process. Had we both known the costs, we could have talked about different options and I might have shopped around to have the test done elsewhere.

Healthcare price transparency tools currently available

There are currently ways for healthcare consumers to find some price information, but these tools are incumbent on the patient to go out and do some research. For example, my insurance company, Blue Cross Blue Shield, has a price estimator tool on its website where you can learn how much various procedures and tests are estimated to cost at different hospitals or test centers. Such a tool is of little help, though, when you are with your provider and that person recommends a test to be done immediately. (And, for the record, the highest estimated blood test cost on the site was $62.)

I found the Fair Health Consumer website a little easier to navigate, but it also requires knowing the exact code for your procedure or test to get the most accurate estimate. The Centers for Medicare & Medicaid Services (CMS) also provides a tool to Medicare patients where they can see the cost of various procedures. But again, these avenues depend on the consumer to do research outside of the office visit rather than having the price discussion be a part of the conversation.

The push for greater healthcare price transparency

The federal government right now is considering several initiatives to both limit surprise medical bills and to increase healthcare price transparency. Among the initiatives being discussed:

- Banning separate out-of-network bills for patients being treated in the ER.

- Consolidating all charges for an episode of care into a single bill for patients. Right now, they are often presented with several bills – for example, receiving separate bills from the hospital, the radiologist, and the anesthesiologist.

- An executive order forcing insurers, hospitals, and doctors to divulge data to consumers and employers on discounted or negotiated rates between parties.

- Congressional legislation that would require hospitals and health plans to provide a good faith estimate on out-of-pocket costs to consumers within 48 hours of a recommended procedure or course of treatment.

Conclusion

Healthcare costs in the U.S. have now reached a staggering $3.5 trillion, which amounts to $10,739 per person. The average U.S. family is responsible for a significant portion of those costs out-of-pocket.

There are few industries in which there currently exists such a large information asymmetry, in which consumers rarely know the cost of what they purchasing ahead of time. It will be interesting to see how various initiatives shake out over the coming weeks and months, and whether they get entangled in politics. It will also be interesting to see how much we can bring healthcare price transparency to consumers instead of requiring them to go out and do the research on their own.

This article was originally published on the Dimensional Insight blog and is republished here with permission.