By Jeff Jones, Business Project Analyst, GroupOne Health Source Inc.

By Jeff Jones, Business Project Analyst, GroupOne Health Source Inc.

Twitter: @GroupOne_Health

Declining reimbursement is one of the greatest financial challenges physicians face today. While there isn’t much you can do to stop reimbursement cuts, you can be proactive in learning about the Merit Based Incentive Payment System and how it will impact physician reimbursement.

Fee-for-Service vs. Value Based Reimbursement

Currently, physicians are being reimbursed on a fee-for-service basis. This means physicians are paid for every office visit, test, or procedure they perform. In order to cover overhead, salary, and keep their doors open, physicians are influenced to see as many patients as possible and choose tests or procedures that have the highest reimbursements rates, even if there is a treatment that is just as effective at a lower cost.

The controversy is that physicians are not spending enough quality time with patients, and may not be utilizing resources as effectively as possible. In order to combat this issue the U.S. Department of Health and Human Services is proposing that 90% of Medicare payments be tied to quality by 2018.

This effort to increase value-based payment is accelerated by the Merit-Based Incentive Payment System (MIPS), which drastically affects how a physician is reimbursed.

What is MIPS?

The Merit-based Incentive Payment System is CMS’s new attempt to control Medicare Spending. This program consolidates three existing programs and one new program, in order to derive a MIPS score, from 0 to 100, which can significantly impact a provider’s Medicare reimbursements for each payment year. The programs and their respective maximum points are as follows:

- VBM-measured quality (up to 30 points) – Value-Based Modifier

- VBM-measured resource use (30 points)

- MU (25 points) – Meaningful Use

- Clinical Practice Improvement (15 points)

Who is Eligible for MIPS?

For the first two years of MIPS CMS has deemed the following Medicare Part B providers as eligible professionals:

- physicians

- physician assistants

- nurse practitioners

- clinical nurse specialists

- nurse anesthetists

For the third and subsequent years, the following Medicare Part B providers also become MIPS-eligible:

- physical or occupational therapists

- speech-language pathologists

- audiologists

- nurse midwives

- clinical social workers

- clinical psychologists

- dietitians or nutrition professionals

As you can see the list of eligible professionals starts out with the highest level providers but quickly expands to cover a large majority of providers.

Who is excluded from MIPS?

However, some providers may be excluded from MIPS. Providers who participate in an APM (alternative payment model) will be excluded. Also, CMS is set to define a low-volume threshold that includes a combination of minimum Medicare patients, service volume, and/or billings below which a provider will be excluded from MIPS. Finally, providers who enroll in Medicare for the first time during a performance year are exempt from MIPS until the following year.

How Your MIPS Score Impacts Reimbursement

The first payment year is set to be 2019, and because MIPS follows the same 2-year lag of similar programs, 2017 is set to be the first performance year of MIPS.

MIPS consists of four programs, three of which currently exist. For the 2016 performance year (and the respective 2018 payment year), these three programs (MU, VBM, and PQRS) will continue as separate and distinct measurement and payment adjustments until the 2017 performance year, at which time they will be consolidated with the fourth and new program (clinical practice improvement) to generate a provider’s MIPS score.

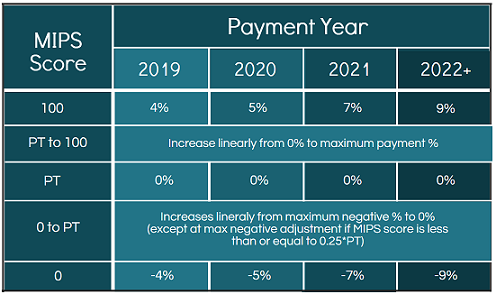

The MIPS score will have a maximum impact of +/-4% on reimbursement for the 2019 payment year and this maximum impact will increase to +/-9% for the 2022 and subsequent payment years. Below is a table showing the year-to-year increases for maximum penalties and incentives and how the percentages are calculated in between.

PT = Performance Threshold

PT = Performance Threshold

The maximum positive adjustments shown may not be the highest adjustment providers could see. The maximum payment adjustment is multiplied by a scaling factor so that the total of all positive and negative adjustments across all MIPS eligible providers, results in either neutral or reducing impacts on Medicare budgetary spending. Thus, controlling or reducing Medicare spending on physician services.

Put more simply, the winners of MIPS will gain their positive payment adjustments from the losers of MIPS, who are penalized with negative payment adjustments. As a result of this the maximum payment adjustment for any year could, in theory, be up to 3 times that shown in the row for the MIPS score of 100.

What is the MIPS Performance Threshold?

The performance threshold (PT) is the demarcation MIPS score between positive or negative adjustments and is determined every year as the mean or median of the MIPS scores for all EPs in a prior period as selected by CMS. The PT will likely be specified in an annual CMS final rule which will be published prior to each performance year.

The scores in between the maximum positive and negative adjustments are calculated on a linear basis. For example, if the PT is set at 40 and provider A scores a 35 while provider B scores a 20, provider A’s negative reimbursement would be just below 0% (around -0.5%), while provider B’s negative reimbursement would be lower than that (around -2.0%). The only exception is at the max negative adjustment if the MIPS score is less than or equal to 0.25 * PT. For example, if the PT was set at 40, then a score of (40*0.25) 10 or below would garner the max negative adjustment.

No Neutral Tier

Unlike other programs, MIPS does not feature a “neutral tier” where providers MIPS scores will yield no payment adjustments. As shown in the table, only a MIPS score of exactly the PT would result in a 0% payment adjustment. Thus, almost all MIPS eligible providers will either experience a positive or negative adjustment, which enhances the financial impacts of MIPS on eligible and soon to be eligible providers.

Exceptional Performance Bonus & Year-Over-Year Improvements

There are two additional features to note of the MIPS score and payment policies. First, CMS will define an “exceptional performance” bonus in the form of an additional payment adjustment of up to 10% for eligible providers who are above the 25th percentile of positive MIPS scores. This is a significant incentive advantage for each performance year, and as such, should increase providers’ motivation to preform highly on MIPS year after year.

Secondly, CMS is authorized to “take into account” year-over-year improvement of MIPS eligible providers in order to calculate the scores for the PQRS and VBM categories. Meaning low-performing MIPS eligible professionals may still receive credit from improving their scores even if the new scores are still in the lower tiers. This policy should encourage low performing providers to continue to improve.

The key takeaways are that no one knows where the PTs will fall, so the performance of MIPS eligible providers is extremely important if they want the best shot at receiving positive payment adjustments. Also, because there is no neutral zone, MIPS eligible providers will almost always receive positive payments or negative penalty adjustments.

The only way a provider won’t see a positive or negative adjustment is if they score exactly the PT for that year. This is very unlikely because the PT is only a single number between 0 and 100, and not a zone of scores.

Will you lose patients because of MIPS?

Each physician has worked years to create a brand that they embody and project to the public. But many physicians might wonder how much their brand actually impacts the level of patients they see or the level of referrals they receive from current patients.

With MIPS these physicians will wonder no more. MIPS scores are going to be publicly reported on the CMS Physician Compare consumer website.