By Randy Pate, CMS Deputy Administrator and the Director of the Center for Consumer Information and Insurance Oversight

By Randy Pate, CMS Deputy Administrator and the Director of the Center for Consumer Information and Insurance Oversight

Twitter: @CMSGov

Millions of Americans enjoy the flexibility, lower premiums, and tax advantages of enrolling in a Health Savings Account (HSA) through their jobs. But did you know that you can also enroll in an HSA-eligible High Deductible Health Plan (HDHP) in the individual health insurance market through HealthCare.gov?

Coupling an HSA-eligible HDHP with a Health Savings Account is often something that employers offer to provide for their employees. However, the same opportunity exists for millions of Americans who don’t get health insurance through their jobs, but who want to take advantage of the benefits HSA’s provide. Not only are HSA-eligible HDHP premiums generally lower than other plans, but Americans who select an HSA-eligible plan through HealthCare.gov and then open an HSA are able to put additional money aside in their tax-preferred HSA to help with future health care costs. You can see which HDHPs are HSA-eligible by sorting the results when browsing plan options on HealthCare.gov and select a plan that works best for you. Individuals must be enrolled in an HSA-eligible HDHP in order to set up an HSA and deduct contributions from their income. It’s easier to do than you might think.

Just for some background, an HSA is a savings account—just like the savings account you might open up at your local bank—that allows you to put aside money for qualified medical expenses your insurance doesn’t cover like deductibles, coinsurance, and copayments or adult dental expenses and glasses or contacts. Unlike a Flexible Spending Arrangement (FSA) you might be familiar with, an HSA is not “use it or lose it.” Instead, it’s a real savings account that belongs to you—and the funds can earn interest and follow you throughout your life, through job changes or other life events. HSA-eligible HDHPs generally have lower monthly premiums but a higher deductible than traditional insurance plans, meaning that you pay health care costs yourself (using money from your HSA savings account) until the deductible has been met, at which point the insurance company starts to pay its share. I’ve been enrolled in an HDHP with an HSA for over seven years now, across multiple jobs, and am very satisfied by my experience with it. It’s been a great way for me to keep my monthly premiums low, put aside some money to save for future health care costs, and keep track of what I spend on health care.

The HSA tax structure provides a number of opportunities for consumers to save for important health care expenses, to be prepared for medical emergencies, and even to plan for retirement down the road. HSA contributions are tax deductible, and interest and other earnings on the account are tax-free.¹ Having an HSA can create an incentive to save and invest for future health care needs as well as retirement; while any withdrawals you make for qualified medical expenses, including expenses while covered by Medicare are tax free, once you reach age 65, non-medical withdrawals from your HSA (such as using HSA funds to buy a house) are taxed just like regular income.

While anyone with an eligible HDHP can open and use an HSA, self-employed and business owners may particularly benefit from these types of plans. That’s because you can deduct HSA contributions from your income, and the contributions from self-employment, or payroll taxes.

HSAs have grown in popularity within the group market, and they remain an area that has a lot of opportunity for growth on the Exchanges and the individual market. In 2017, almost 500,000 consumers in states with an Exchange using the HealthCare.gov platform chose to enroll in an HSA-eligible HDHP.

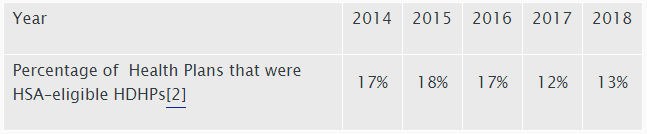

Table 1: HSA-eligible HDHPs Offered through the Federally-facilitated Exchange

Note: 2014 data was as of 5/27/14, 2015 was as of 11/03/14, 2016 was as of 10/29/15, 2017 was as of 11/05/16, 2018 was as of 11/07/17.

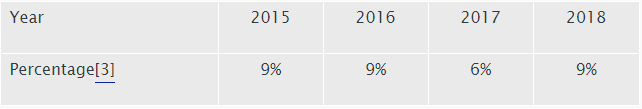

Table 2: HSA-eligible enrollment and percent of total Federal Exchange enrollment

Note: 2015 enrollment was as of 5/6/15, 2016 enrollment was as of 8/22/16, 2017 enrollment is as of 5/31/17, and 2018 enrollment is as of 12/23/17.

We want to ensure that you can make an informed decision on whether an HSA is right for you. Our goal is to put you and your family in control of your health care dollars and decisions, and we are working to help you understand how to use this type of coverage to take charge of your care as well as health care costs.

I encourage you to learn more about HSA-eligible plans and HSAs by checking out our resources on HealthCare.gov, our HSA Fact Sheet, and by viewing additional information on the IRS website.

¹ IRS Publication 969 (February 2017)

² For each county, looking at Individual QHP standard plans (no variants), the percent of plans that are HSA-eligible in that county was calculated. The percent of HSA-eligible plans for each county was weighted by the enrollment in that county to get the enrollee weighted percent of HSA-eligible plans that are available to an enrollee.

³ The enrollees above divided by the total number of all enrollees in the market.

This article was originally published on The CMS Blog and is republished here with permission.